Your Criminal

Defense Team

Leveraging Both Sides Of The Law To Provide The Strongest Defense Possible. One of CNY’s Most Knowledgeable and Experienced Criminal Defense & DWI Law Firms.

Message Your Team

Our Google Reviews

Hear from our clients:

Types of Cases

Cambareri & Brenneck is a firm founded by and comprised of former prosecutors. Because our attorneys have experience on both sides of the courtroom, we know how to get results.

Trust Central New York’s

Most Experienced

Criminal &

DWI

Defense Team

Your Criminal

Defense Team

Cambareri & Brenneck is a firm founded by and comprised of former prosecutors. Because our attorneys have experience on both sides of the courtroom, our clients can trust that their case will be effectively navigated through the criminal justice system. Every viable avenue toward a positive outcome will be exhaustively pursued.

Your Criminal Defense Team

Steve Cambareri

Partner, Attorney

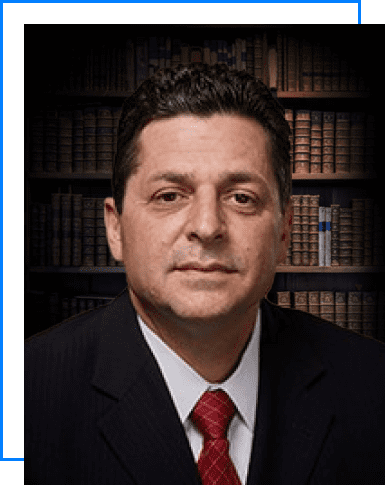

Scott A. Brenneck

Partner, Attorney

Judge John

Centra (Ret.)

Special Counsel

Melissa K. Swartz

Attorney

Joe Centra

Attorney

Ken Tyler

Attorney

Michele Previte

Office Manager